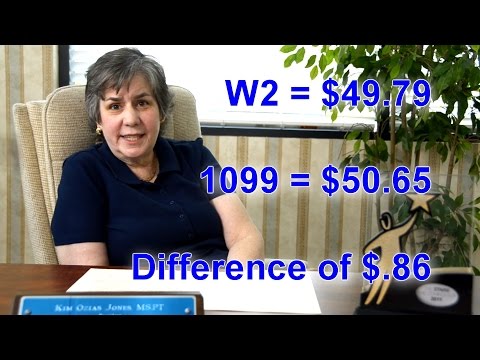

With over 35 years of experience as a licensed physical therapist, Kim Jones served as a director for three facilities before founding her own rehab staffing company. At the time, she served as both the president and the only employee. Today, we will hear from her about the benefits of working as a W-2 employee and the hidden costs of 1099 independent contractor work. Let's say you've been offered a job with a potential employer who has offered you a fantastic rate of pay. However, there's only one caveat: they want you to be a 1099 independent contractor. Before you agree to this, there are some important things that you need to consider. Before we go any further, I want you to know that this is just a general overview and you should contact a tax attorney or legal consultant before making this decision. But here are some things you should consider. Let's break them into three categories. First, let's consider the government's legal definition of an independent contractor. Second, let's discuss the liabilities that you will incur. And third, let's examine the all-important sum of money. Both the IRS and the California Employment Development Department have definitions of independent contractors and employees, and surprisingly, they are not the same. The definitions differ, and actually, California has more secondary factors that can get really specific. But let's keep to the general information and go with the IRS definition. There are three areas of control: behavioral, financial, and relationship. Behavioral control looks at who has the right or control over the work that will be done and how it will be done. So, in a clinical situation, this can mean things like: does the business tell you what time to come in? Do they tell you what patients you're going to see? If so, that...

Award-winning PDF software

1099-g california turbotax Form: What You Should Know

Tax Notes : If you received compensation based on unemployment benefits, you may need to withhold the amount of the unemployment tax in advance (for more details on withholding payments, see). Form 1099G, Certain Government Payments, is a report that documents payments of unemployment tax that may or may not be taxable. (Click for larger image) Here's my example: I file Form 1099-G by January 30. It lists my gross income for 2025 of 80,000. I'm making monthly payments to the state of California for unemployment compensation of 12,000. As I pay unemployment taxes, I also have a tax return for tax year 2025 (Form 1040). The taxable income from California, which is reported on my tax returns, is: (Click for larger image) On my tax return, I itemize my personal exemptions. That means that I itemize my deductions rather than taking the standard deduction. Itemizing provides additional deductions that are deducted on my tax return. Tax law allows your standard deduction to be reduced by an amount equal to the amount of standard deductions you claim for other taxpayers for the same tax year and for every year after that. This has the effect of reducing the amount of income tax you pay. If I itemize my deductions this year, it means that my gross income, as reported on my California tax return (80,000) does not exceed: I have personal exemptions of 14,300 which is reduced by 2,611 And here is a sample summary for California unemployment tax: 1099-G Income Tax for Total, Unreduced California Wages In 2017, 13,879 received in unemployment compensation as compensation under Federal Unemployment Tax Act I have paid California unemployment tax. The amount of tax you pay is the amount of any unemployment tax you paid in 2017. This is for total wages, including gross wages, fewer deductions. This includes unemployment compensation, including unemployment tax. The taxes deducted from gross wages that were used to calculate gross income does not count as unemployment income. For more information on this rule see.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1099-G, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1099-G online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1099-G by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1099-G from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1099-g california turbotax